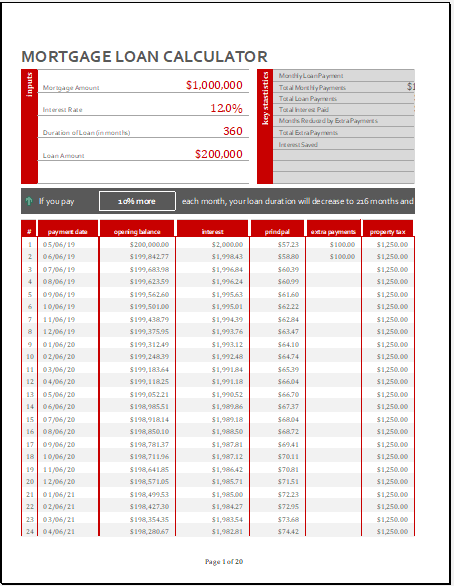

The most popular place to start is our borrowing calculator or our affordability calculator. It’s a simple-to-use tool that allows you to calculate and compare the costs of the best offers on the market. Which mortgage calculator is right for me? Calculate monthly mortgage payments and current mortgage rates with Fifth Third Banks mortgage payment calculator. Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages. We won’t ask about groceries, utility bills or travel. Why you’re applying – for example, buying your first home, moving home, or buying a second home.If you fail to qualify for that product, you may be offered a mortgage that does have an appraisal fee, borrower-paid PMI, and a tax escrow account. The payment calculations above do not include property taxes, homeowners insurance and private mortgage insurance (PMI). Applicable to our portfolio mortgage product. How much you regularly spend – on things like your credit or store cards, loans, overdrafts, maintenance and pension Submit Mortgage Inquiry Lender paid Private Mortgage Insurance on loans 89.5 Loan-to-value and over.When you apply for a mortgage or use our calculator, we’ll ask you for information like What information do I need to use a calculator and how do you decide what I can afford? Use this Credit Union West mortgage calculator to determine your monthly payment, estimated principal balances, and generate an estimated amortization. It’s for you if you’re a first time buyer, you’re looking to remortgage, move or buy an additional home, or you’re a buy-to-let landlord. Amortization Calculator Monthly Pay: 1,687.71 Loan Amortization Graph Balance Interest Payment 0yr 5yr 10yr 15yr 0 100.0K 200.0K 300.0K 400. To get a better sense of the total costs of buying a home, use our home mortgage calculator and figure out what your future mortgage payments might be.

We have different calculators that can help you in different ways – each calculator does something slightly different. So you can think of a loan as an annuity you pay to a lending institution.It’s a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

MORTGAGE FINANCE CALCULATOR PLUS

When you take out a loan, you must pay back the loan plus interest by making regular payments to the bank. For additional compounding options use our They typically have 10-, 15-, 20- or 30-year loan terms, but other terms may be available. Compounding This calculator assumes interest compounding occurs monthly as with payments. Fixed-rate mortgage calculator Fixed-rate loans offer a consistent rate and monthly payment over the life of the loan. This mortgage calculator is a well-equipped loan calculator that deals with multiple questions arising when you are about to buy a house with a mortgage loan.As the primal function, it enables you to estimate your payment with different loan constructions and compare them alongside its connected costs, especially its interest payments. Monthly Payment The amount to be paid toward the loan at each monthly payment due date.

Number of Months The number of payments required to repay the loan. Interest Rate The annual nominal interest rate, or stated rate of the loan. Loan Amount The original principal on a new loan or principal remaining on an existing loan. visit your branch to seek personalized advice from qualified professionals for all personal finance issues. Enter the dollar amount of the loan using just numbers and the decimal. You can also create and print a loan amortization schedule to see how your monthly payment will pay-off the loan principal plus interest over the course of the loan. Whitefish Credit Union can help you consider all the factors that go into your monthly mortgage payment with this financial calculator. This script calculates the monthly payment of a typical mortgage contract. Find your ideal payment by changing loan amount, interest rate and term and seeing the effect on payment amount.

Use this loan calculator to determine your monthly payment, interest rate, number of months or principal amount on a loan.

0 kommentar(er)

0 kommentar(er)